Planning and executing mixed-method research to better understand how compliance experts and anti-money laundering officers tackle financial crime risk in payments and transactions.

2023-2024 / Cloud-based web application, B2B, SaaS

Background

Elucidate is a leader in financial crime risk management, enabling financial institutions to benchmark and price financial crime risk through its innovative platform, the Elucidate FinCrime Index (EFI). Developed in collaboration with leading global correspondent banks, the EFI stands as the market’s first regulated financial crime risk benchmark, authorized by the Federal Financial Supervisory Authority (BaFin) and registered with the European Security and Markets Authority (ESMA).

This case study showcases key moments in a user research initiative aimed at uncovering a "killer feature" while gathering valuable feedback from our customers. The goal was to identify opportunities to enhance the product and better align it with user needs. I led the research efforts, conducting interviews and synthesizing insights, which informed both product improvements and strategic decisions for future development.

Context & planning

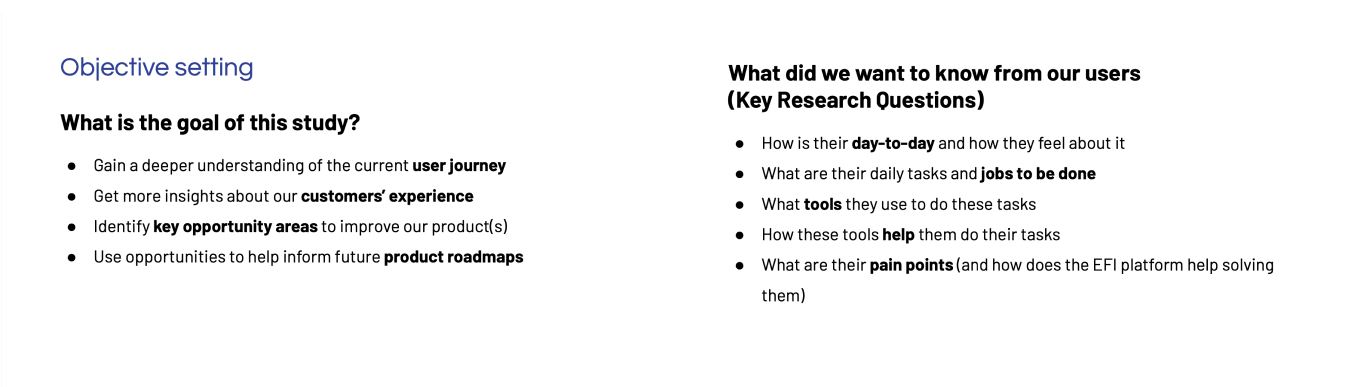

I collaborated closely with the product team and key stakeholders to define clear objectives and a structured research plan. These objectives included gaining a deeper understanding of user workflows, identifying challenges in their processes, and exploring how the platform could better meet their needs. The research plan also aimed to gather actionable insights to inform future product development and prioritize features for the roadmap.

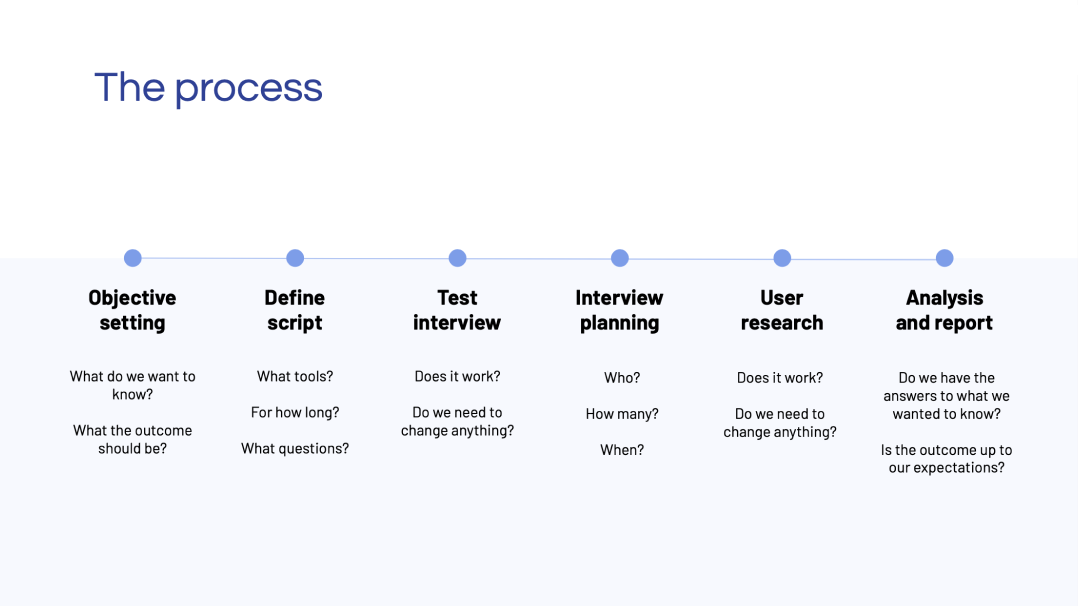

Methodology

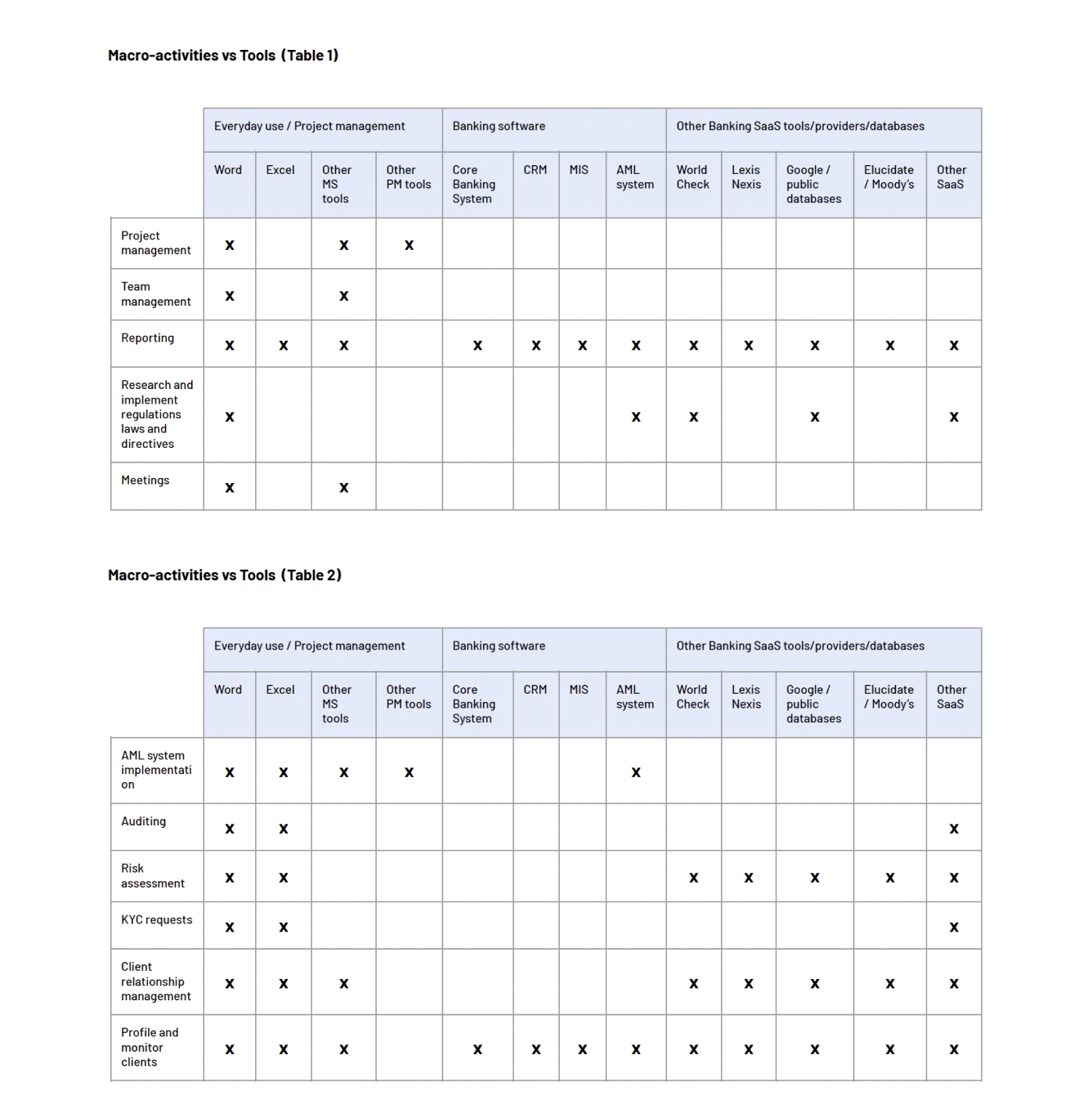

To gather meaningful insights, we adopted a hybrid approach that combined quantitative and qualitative methods. We began with a survey to collect broad, preliminary data on user needs and experiences, followed by in-depth, semi-structured interviews to explore these insights further. Using tools like SurveyMonkey for surveys and Miro and Zoom for interviews, we ensured the process was efficient and collaborative.

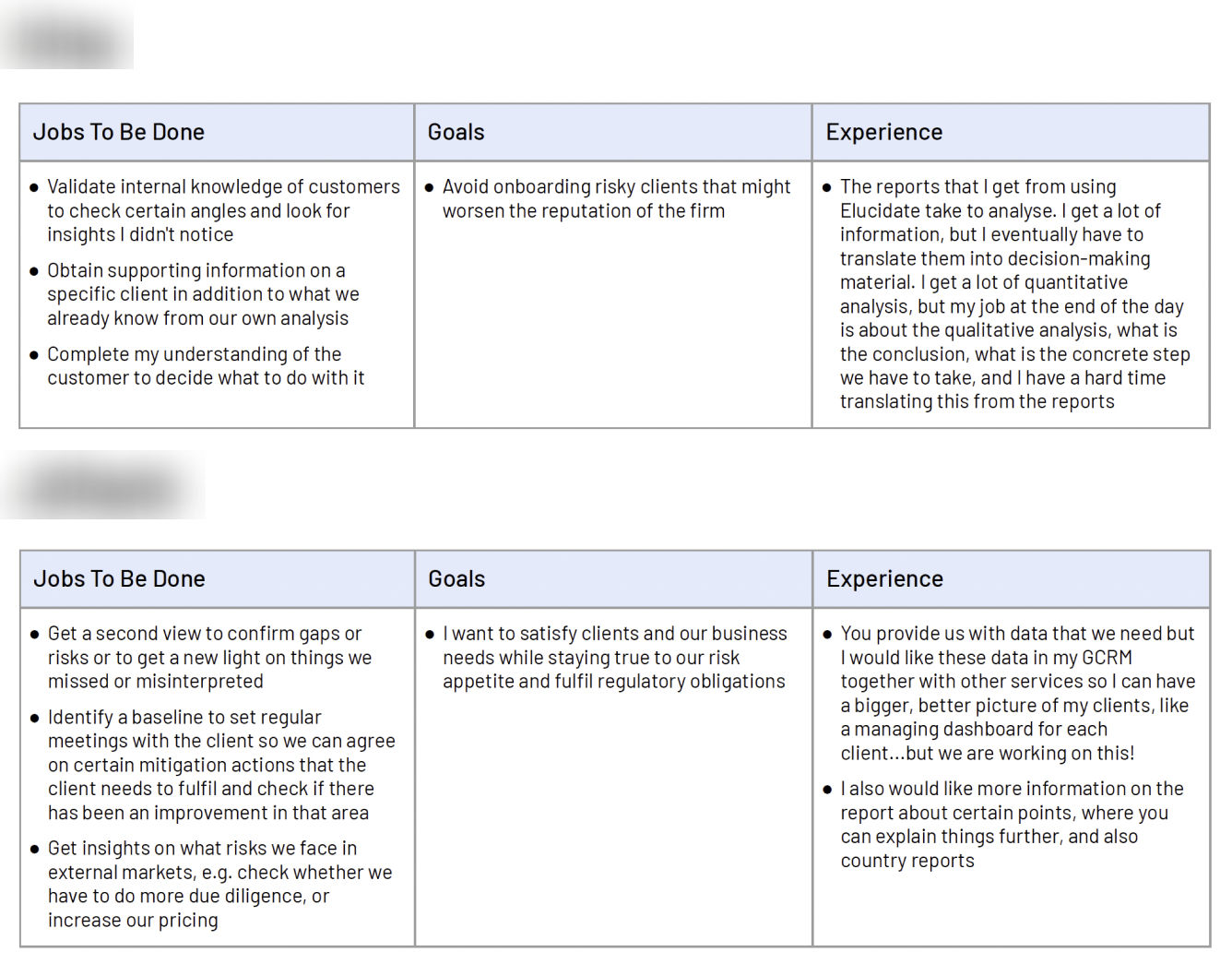

The participant pool was chosen to represent a mix of long-term and recently onboarded users. Roles varied across compliance, risk management, and due diligence, allowing us to capture diverse perspectives and experiences. This diversity helped paint a comprehensive picture of user workflows and challenges while revealing commonalities across different roles and institutions.

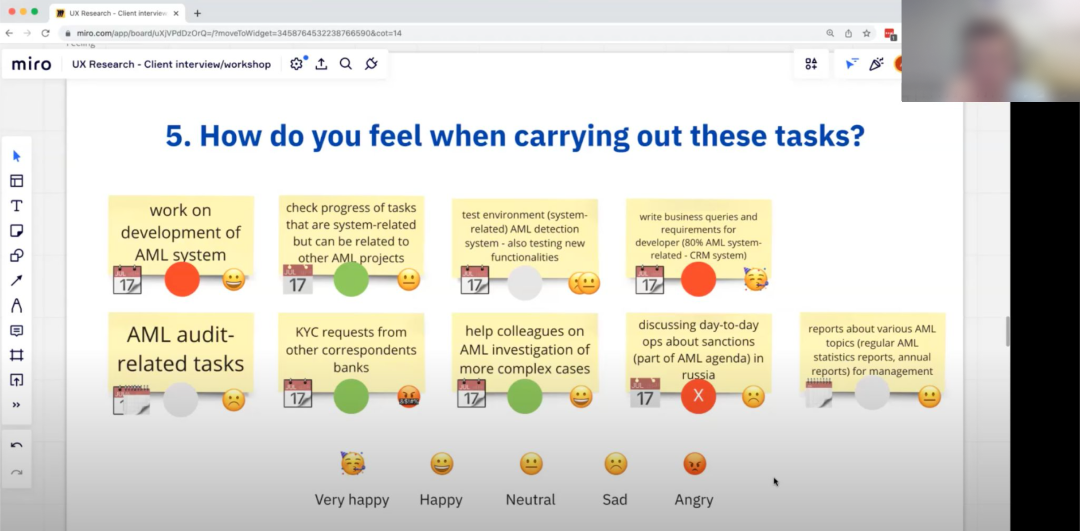

Throughout the process, the interviews were designed to be interactive and flexible. Questions focused on understanding participants' daily tasks, the tools they used, and the specific pain points they encountered. This approach fostered open dialogue, enabling us to dig deeper into users' frustrations and desires while building rapport with participants. The combination of structured and exploratory methods ensured rich, actionable data for the next phase.

Analysis

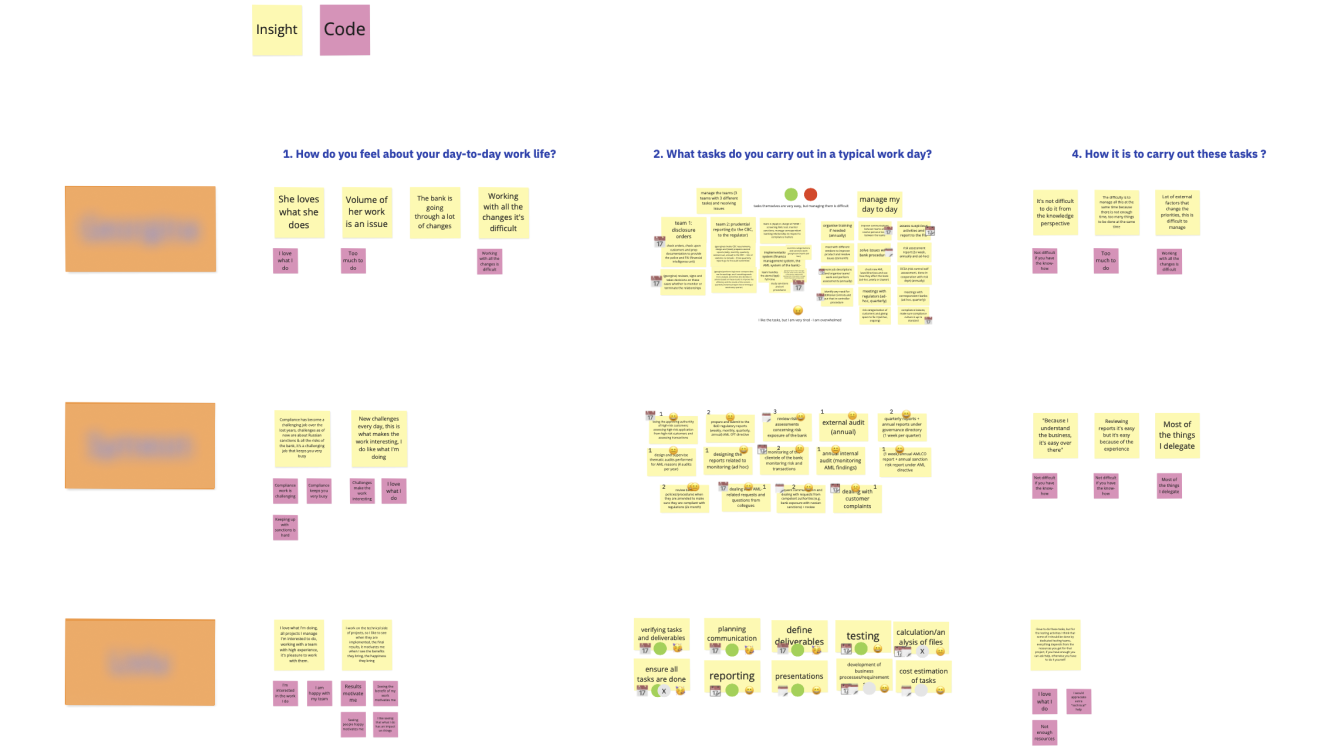

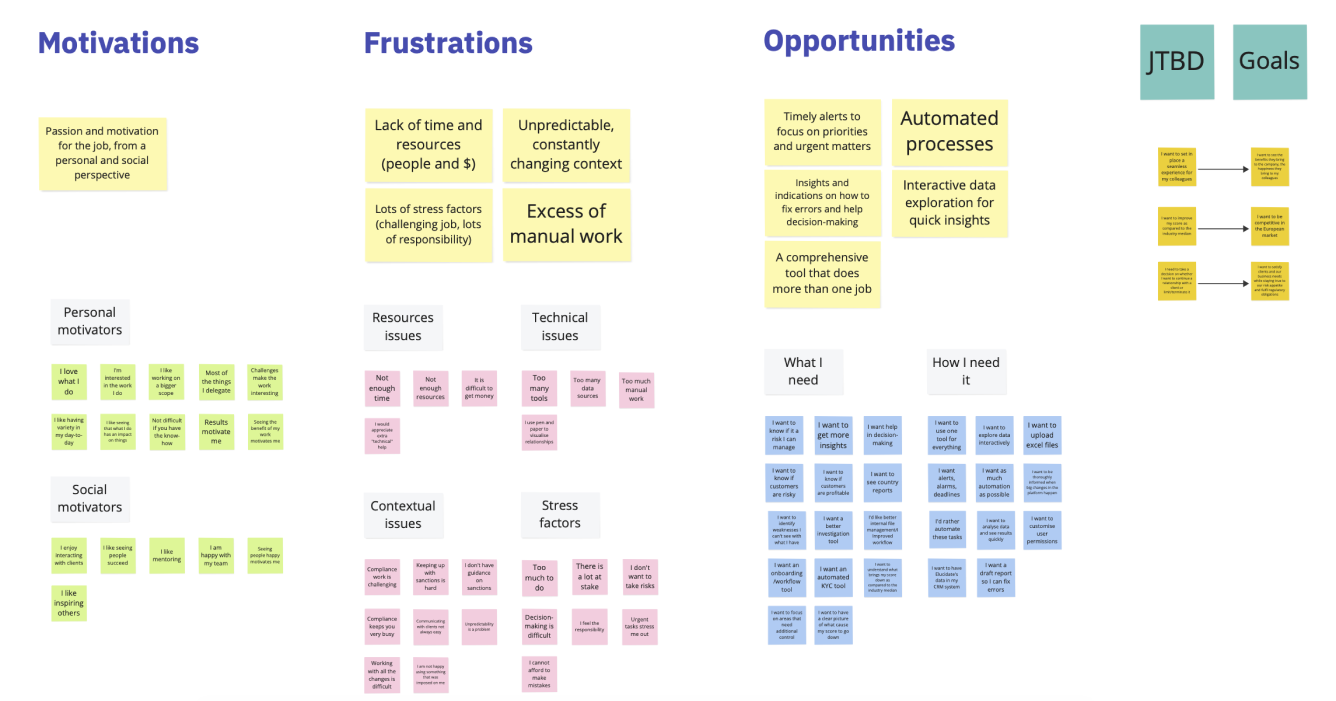

We began by clustering feedback from interviews and surveys into themes, identifying trends and patterns that spanned different roles and institutions. Tasks were categorized based on frequency, difficulty, and user sentiment, providing a nuanced view of how users navigated their day-to-day workflows.

The process involved creating detailed transcripts of the interviews and extracting meaningful insights. These insights were coded — summarized into concise phrases — and organized into topics of interest. Codes were then iteratively clustered into broader themes by identifying similarities and patterns. Adjustments were made throughout the process, splitting or regrouping themes as needed to ensure clarity and alignment with the research questions.

Finally, each theme was defined and documented to capture its essence and its relevance to the study’s goals. This structured approach not only provided clarity but also ensured that the themes effectively answered the core research questions, laying a strong foundation for subsequent reporting and ideation phases.

Findings

The research uncovered several critical insights about how users interacted with the compliance platform and their broader workflows. While most participants expressed satisfaction with the platform’s existing features, many pointed to inefficiencies caused by manual processes and the need to juggle multiple tools. Users emphasized the importance of streamlining workflows to save time and reduce the burden of compliance tasks.

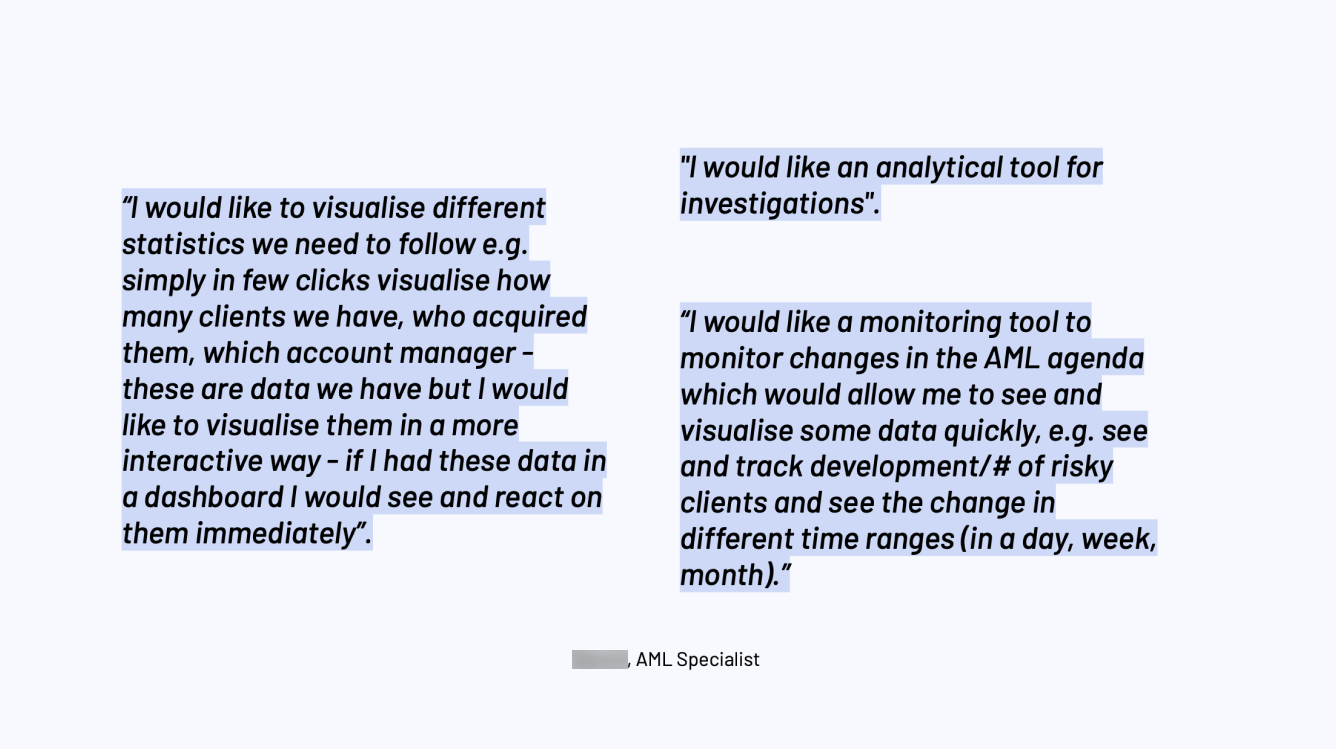

Another key finding was the desire for a centralized, “one-stop-shop” solution that could integrate data from various sources, automate repetitive tasks, and provide actionable insights. Participants frequently highlighted the need for better visualization tools and dynamic data exploration features to help them make quicker, more informed decisions. These enhancements were viewed as essential for improving both individual productivity and team efficiency.

Despite challenges, users expressed a strong sense of expertise and passion for their work. They valued tools that complemented their skills and allowed them to focus on high-impact tasks. This feedback reinforced the need for a platform that not only simplifies workflows but also empowers users by providing advanced capabilities for those with higher technical proficiency.

Outcomes

The research findings were instrumental in shaping the product roadmap, leading to tangible outcomes that addressed user needs. Key recommendations included integrating automation to reduce manual effort, enhancing data visualization tools for better insights, including new tools to help users in their decision-making process, and consolidating features into a unified interface.

These insights led to Elucidate's Risk Module Builder, a "build-your-own" risk analysis system where users can pick and combine modules like data validation, compliance monitoring, and transaction pattern analysis. Each module works on its own, but also work together to create a complete risk assessment system that integrates with users’ existing tools.